As President Donald Trump completes his first 100 days in office during his second term, his sweeping tariff strategy has become one of the most contentious economic policies in recent memory. The measures — described by the White House as a bold bid to reduce the U.S. trade deficit and strengthen domestic industries — have drawn both applause and intense criticism from economists, business leaders, and global markets alike.

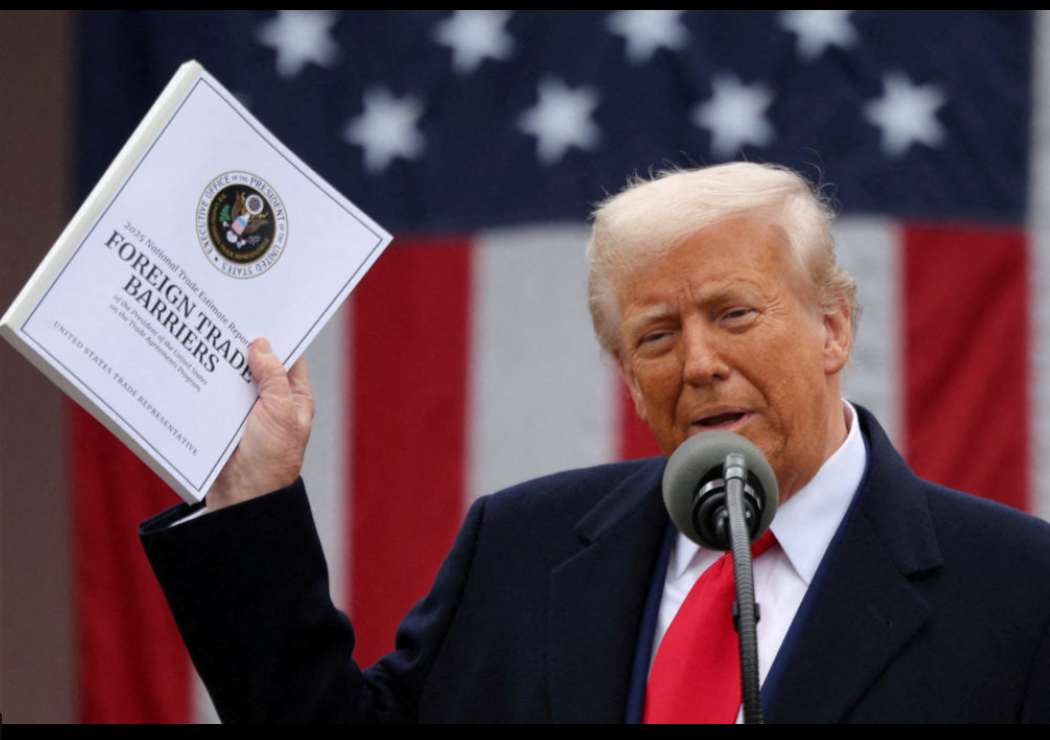

At the center of Trump’s approach are aggressive tariffs on a wide range of imported goods. The administration has framed these levies as reciprocal duties, designed to mirror or surpass the trade barriers imposed on American products by other nations. Tariff rates vary by country and industry, with selected tariffs reaching exceptionally high levels on certain imports. The White House argues that this shift will help protect American jobs, support manufacturing, and incentivize foreign companies to onshore production. Wikipedia

However, the economic gamble comes with significant risks. Trade data and analysts suggest the tariffs have already contributed to disruption in supply chains, rising consumer prices, and a slowdown in certain sectors. Everyday goods such as food, clothing, electronics, and automobiles have seen increased costs, placing additional pressure on American households and small businesses. Critics argue that the tariffs function like hidden taxes on consumers, rather than costs borne solely by foreign producers. The Express Tribune

Global markets have reacted sharply to the new policy environment. Stock exchanges experienced severe volatility in the weeks following the announcement of broad tariff measures, with major indexes plunging in what has been described as one of the most dramatic sell-offs since the pandemic era. Investors remain cautious as uncertainty lingers over how trade partners will respond and whether the tariffs will deliver their intended economic benefits. Wikipedia

International reactions have been mixed. Some countries have engaged in negotiations with U.S. officials in hopes of securing trade agreements that could soften the economic impact, while others have retaliated with their own tariffs or remained cautious in their diplomatic posture. The negotiations — including talks with key partners like Japan — underscore the delicate balancing act between asserting trade leverage and maintaining global economic stability. https://www.fox10tv.com

Supporters of the tariff strategy maintain that temporary pain for American consumers may be justified if it ultimately leads to a stronger industrial base and greater long-term economic independence. The administration has argued that trade imbalances have hurt U.S. workers and that protective duties are a necessary corrective tool. Trump himself has acknowledged that some price increases might occur in the short term but insists that broad benefits will emerge over time.

Yet not all economic observers are convinced. Many economists warn that tariffs introduced amid existing inflationary pressures risk fueling broader price rises and could slow job growth. Some have even suggested that the tariffs increase the odds of a recession if supply chain tensions and global retaliation intensify. Opponents argue that the disruption could outweigh any gains from reshoring production. AInvest

As Trump’s tariff play unfolds, the debate over its effectiveness continues. With markets, consumers, and international partners watching closely, the next stage of negotiations and economic performance will be pivotal in determining whether this high-stakes gamble pays off or backfires.